TrendSpider vs Tickeron: Full Comparison of Features, Tools, and Use Cases

Compare TrendSpider vs Tickeron in this 2025 in-depth review. Discover which trading platform is better for technical analysis, AI predictions, backtesting, and smart alerts. Ideal for both beginner and advanced traders.

AI/FUTUREAI ASSISTANTBANKING/CASH-FLOWSTOCK MARKET

Sachin K Chaurasiya

4/13/20253 min read

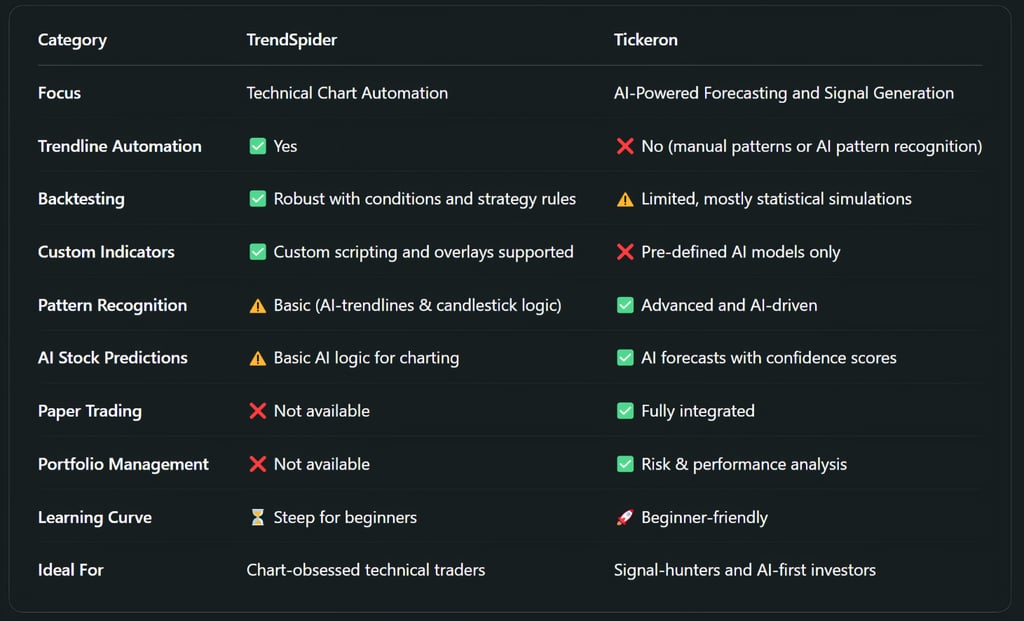

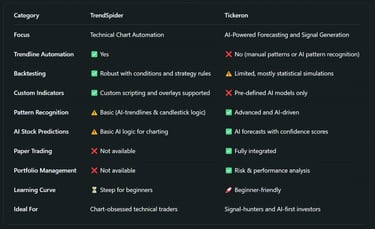

In the modern era of algorithm-driven markets, traders demand more than just basic charting tools. They seek automation, predictive analytics, and AI-enhanced strategies to compete in real-time. Two platforms, TrendSpider and Tickeron, have emerged as powerful yet distinct tools serving this growing need.

While TrendSpider focuses on technical charting automation and strategy development, Tickeron is geared more toward AI stock forecasting, pattern recognition, and portfolio simulation. Let’s dive deep and uncover the technical differences, user experience, and ideal use cases for each.

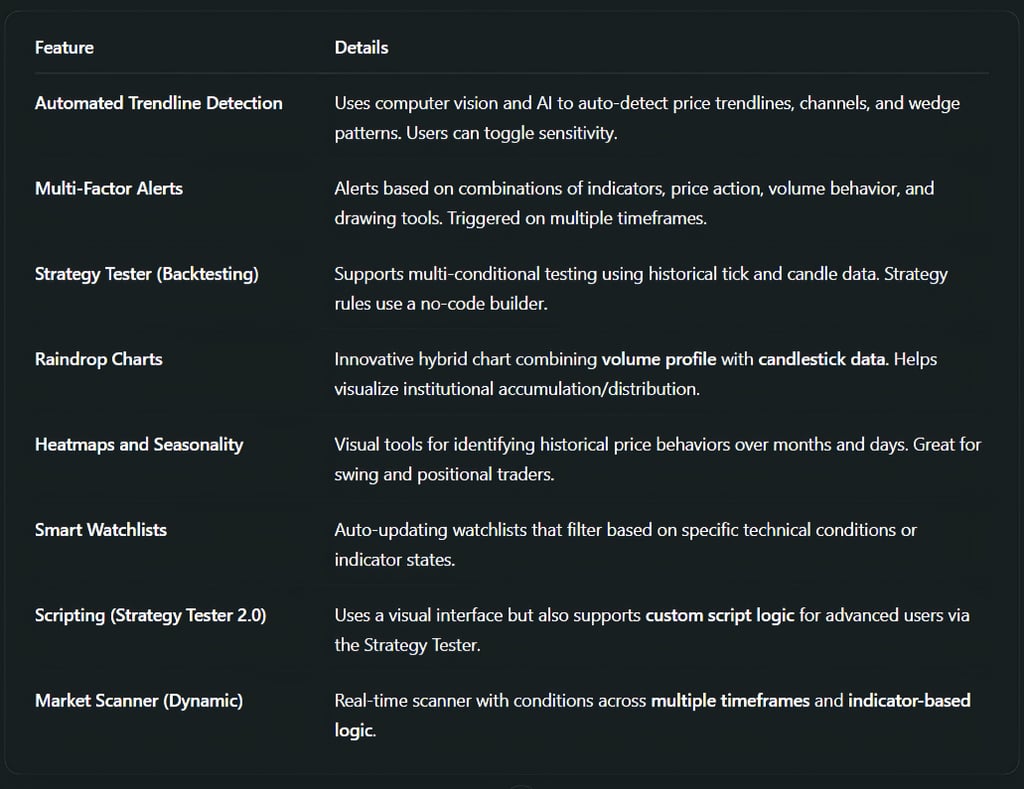

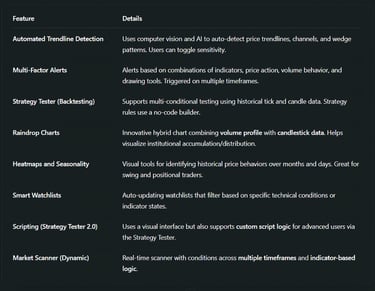

TrendSpider: Technical Analysis on Autopilot

Core Philosophy

TrendSpider is built for quantitatively inclined traders. It seeks to automate the more tedious aspects of technical analysis, allowing traders to focus on strategic thinking and execution rather than drawing trendlines and toggling timeframes.

Pros

AI-Powered Automation: Automating technical analysis tasks frees up traders to focus on strategy development.

Innovative Charting Tools: The inclusion of Raindrop charts and other advanced charting tools provides traders with more insight into market behavior.

Customizable Alerts: Traders can receive real-time notifications based on their trading preferences.

Backtesting Capability: The ability to test strategies with historical data adds a layer of reliability to the decision-making process.

Cons

Steep Learning Curve: While the features are powerful, new users may find the platform complex initially.

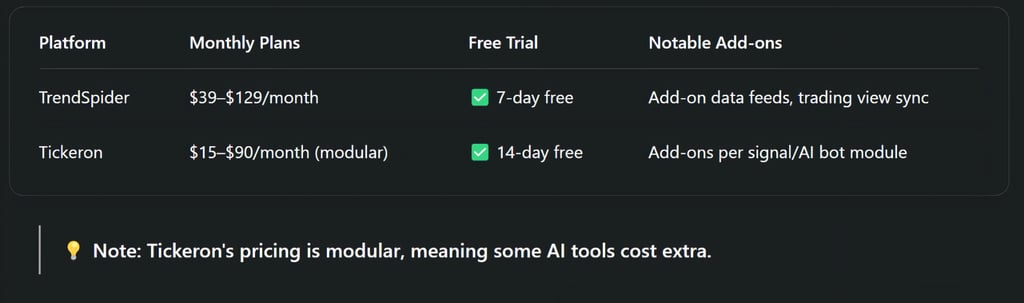

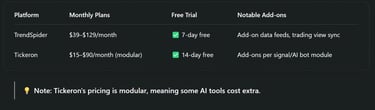

Price: TrendSpider’s subscription can be on the pricier side, which may not be ideal for beginners or casual traders.

Best Suited For

Swing traders and technical analysts.

Traders focused on backtesting and multi-timeframe setups.

Advanced retail traders or prop desk professionals.

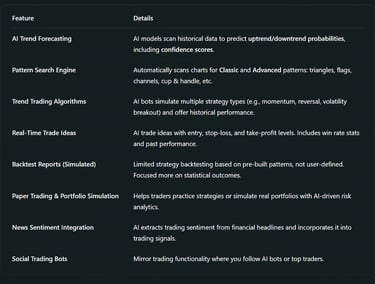

Technical Features in Depth

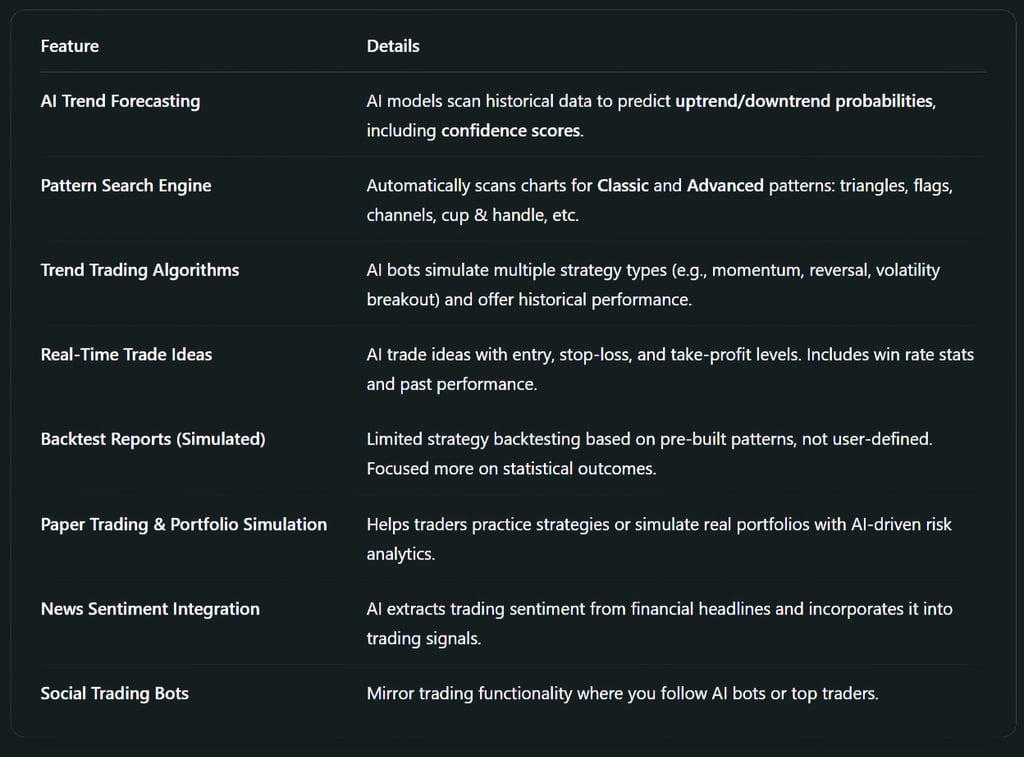

Tickeron: AI Stock Forecasting and Pattern Recognition

Core Philosophy

Tickeron is an AI-first trading ecosystem that emphasizes predictive analytics, pattern identification, and real-time signals. Unlike TrendSpider, it leans toward making pre-built insights accessible for traders who want instant decision-making support.

Pros

AI-Based Predictions: Tickeron’s AI-powered market predictions can help traders make data-driven decisions with greater confidence.

Automatic Pattern Recognition: The platform’s ability to identify technical patterns makes it easier for traders to spot opportunities.

Real-Time Signals: Immediate notifications of buy or sell signals help traders act quickly in volatile markets.

Paper Trading: Beginner-friendly, allowing users to test strategies without the financial risk.

Cons

Accuracy of Predictions: While the AI predictions are based on historical data, there is no guarantee that they will always be correct, as market conditions can change rapidly.

Interface Complexity: Some users find the user interface to be overwhelming due to the wide range of features and options available.

Best Suited For

Beginners and intermediate traders are looking for hand-holding insights.

Traders who want stock picks, trade signals, and AI forecasts.

Investors who prefer fundamental analysis backed with AI-enhanced technicals.

Technical Features in Depth

Use Case Scenarios

Scenario 1: Technical Swing Trader

Needs: Backtest strategies, automate trendline detection, and spot entries/exits using multi-timeframe confirmation.

Go with TrendSpider for Raindrop charts, Strategy Tester, and heatmaps.

Scenario 2: New Retail Investor

Needs: Trade ideas with high confidence, AI-driven alerts, and visual pattern education.

Go with Tickeron for real-time signals, paper trading, and pattern identification.

Scenario 3: Quantitative Portfolio Manager

Needs: Market scanning across conditions, volume profile, and backtested strategies.

TrendSpider wins for market scanner and data-driven strategy optimization.

Which Should You Choose?

Choose TrendSpider if

You are technically skilled or want to level up your charting.

You need serious backtesting, multi-timeframe automation, or custom alerts.

You prefer full control over your strategy rather than relying on predictions.

Choose Tickeron if

You value AI-assisted trade ideas, easy-to-read predictions, and portfolio simulations.

You’re newer to trading and want a data-backed decision assistant.

You like pattern recognition without spending hours on manual charting.

Both TrendSpider and Tickeron offer powerful AI-driven tools for traders, but they cater to different types of users. TrendSpider excels in automating complex technical analysis and providing in-depth charting tools for advanced traders, while Tickeron focuses on delivering real-time trading signals and AI-based trend predictions for users who want actionable insights quickly.

Ultimately, the best choice comes down to your specific needs—whether you prioritize advanced charting and automation or real-time predictions and portfolio management. Each platform has its unique strengths, making them both worthy contenders in the world of trading tools.

Subscribe To Our Newsletter

All © Copyright reserved by Accessible-Learning Hub

| Terms & Conditions

Knowledge is power. Learn with Us. 📚