Tidio AI vs Alpaca API: Best for Building AI-Powered Trading Bots?

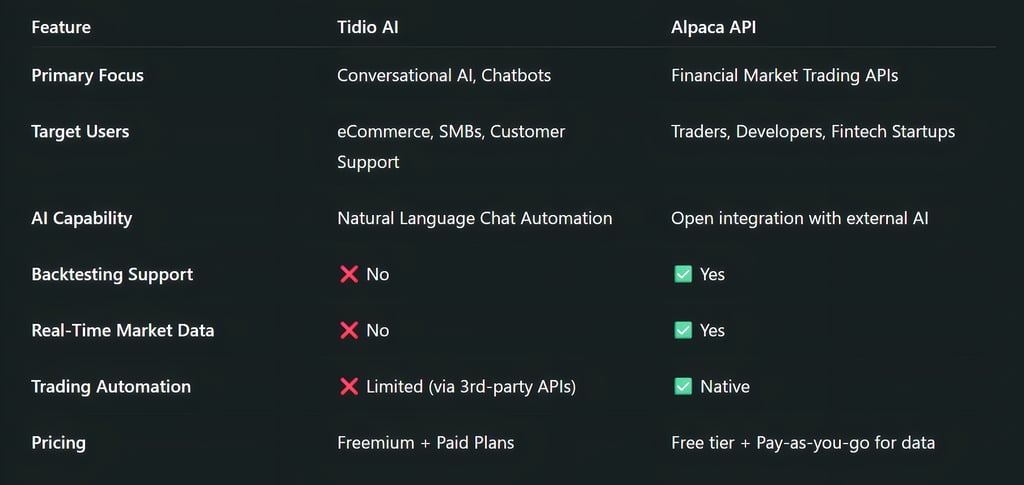

Tidio AI vs Alpaca API—Which platform is ideal for building AI-powered trading bots? Explore this in-depth comparison focusing on core features, advanced technical capabilities, real-time integrations, and use case scenarios to help you choose the best tool for trading automation.

AI/FUTURESTOCK MARKETEDUCATION/KNOWLEDGEEDITOR/TOOLS

Sachin K Chaurasiya

7/6/20255 min read

In the ever-evolving financial tech world, AI-powered trading bots have revolutionized how retail and professional traders approach the market. But the question is no longer if you should use AI—it’s which tool you should choose to build a smart, reliable trading system? Two rising names in this domain are Tidio AI and Alpaca API. Though they serve different primary purposes, both offer integration potential with AI systems. So, which is best suited for creating high-performance trading bots?

Let’s break it down.

Tidio AI: Conversational AI Meets Customer Engagement

Tidio AI is primarily a customer service and sales automation platform powered by conversational AI. It integrates live chat, chatbots, and support tickets into one interface.

Main Use Case: eCommerce customer service and sales enablement.

AI Role: Uses NLP (Natural Language Processing) to generate automated, context-aware responses.

Notable Feature: Lyro AI—Tidio’s generative AI engine for natural conversations.

Verdict

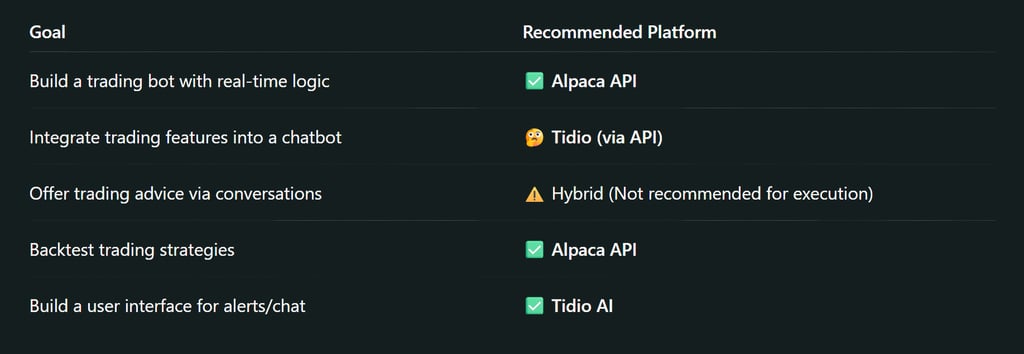

Tidio AI is not built for financial applications, but its chatbot framework and AI logic can technically be repurposed with API-based trading logic for beginner-friendly UI bots.

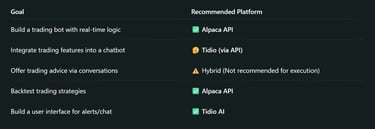

Use Case Deep Dive: Building AI-Powered Trading Bots

Tidio can be used creatively by

Creating conversational interfaces for bots that respond to trading queries.

Connecting Tidio chat with webhooks that trigger API calls to trading platforms like Alpaca or Binance.

Using AI-generated alerts for market updates or portfolio changes.

Ideal For

Making a human-friendly interface for a backend trading bot (but not the bot itself).

Technical Overview: Integration and Customization

API access via Zapier and Webhooks

AI assistant training with FAQs and custom knowledge bases

No native trading logic or market data APIs

Ideal for building customer-facing UIs for financial products

Alpaca API: Commission-Free Stock and Crypto Trading Infrastructure

Alpaca API is a developer-focused trading API that offers commission-free access to US equities and crypto markets. It is tailored for algorithmic trading, backtesting, and portfolio management.

Main Use Case: Building trading bots and algorithmic strategies.

AI Role: Can be integrated with external AI/ML models like TensorFlow, OpenAI, etc.

Notable Feature: Real-time and historical market data + paper trading environment.

Verdict

Alpaca is purpose-built for financial trading automation, making it ideal for direct AI-powered trading bot development.

Use Case Deep Dive: Building AI-Powered Trading Bots

If your goal is to build real-time or rule-based trading bots, Alpaca is a natural fit. You can use

Python or Node.js SDKs to connect to trading endpoints.

Machine learning models to predict price movements or sentiment.

Paper trading features to simulate performance before going live.

Integration with quant frameworks (QuantConnect, Backtrader).

Use Case

Developers, quant traders, fintech startups, and hobbyist algo traders.

Technical Overview: Integration and Customization

REST & WebSocket support

OAuth-based authentication

Customizable order types: market, limit, stop, etc.

Detailed documentation with real-time examples

Advanced Integration: Can integrate with OpenAI's GPT for NLP-based strategies (e.g., news-driven trades)

Tidio AI—Advanced Technical Capabilities

While Tidio AI is not natively built for trading, here are its technical strengths that can be strategically repurposed for front-end interfaces or alert-based trading assistants:

Custom NLP Training via Lyro AI

Lyro uses proprietary machine learning to automatically train chat flows based on uploaded documents or FAQ databases.

Potential Use: Upload financial documentation or strategy playbooks to create a knowledge-aware assistant that can respond to user trading queries.

Webhook-Based AI Triggering

Tidio supports custom webhook integrations to external APIs (like Alpaca, Binance, etc.).

Use Case: Trigger a webhook when a user types “Buy Tesla stock now,” sending a POST request to Alpaca’s order endpoint via a secured backend.

User Attribute-Based Triggers

Tidio AI allows dynamic workflows based on user behavior, tags, or attributes.

You could segment users based on risk profiles or trading interests and push tailored AI responses or alerts (though without execution logic).

Embedding in Financial Dashboards

Tidio’s JavaScript widget is easily embeddable into web apps.

Combine it with React or Angular to overlay a chat layer on top of a trading dashboard for a hybrid control and assistant experience.

Alpaca API—Advanced Trading and AI Integrations

Alpaca is extremely versatile for algo trading and can handle high-performance AI integrations. Here's how:

Streaming Market Data via WebSockets

Alpaca provides low-latency real-time price feeds for stocks and crypto.

WebSocket architecture is ideal for high-frequency trading bots or AI models that need tick-level data for prediction.

Technical Format: wss://stream.data.alpaca.markets/v2/sip for full market depth.

Broker API vs Market API

Alpaca now offers both a Broker API (for client account management) and a Market API (for trading).

For fintech apps, the Broker API allows white-label account onboarding, KYC management, and fully embedded brokerage experiences.

Advanced Order Types & Conditions

Supports conditional orders: bracket orders, OCO (one cancels other), and trailing stops.

Bots can be programmed with adaptive logic: e.g., “place trailing stop-loss if VIX > 20.”

AI Integration Layer (Model Deployment)

Alpaca is model-agnostic and plays well with frameworks like

Scikit-learn or TensorFlow for regression/classification models.

LangChain or OpenAI API for NLP-based signal generation (e.g., from news or tweets).

Architecture Recommendation: Use FastAPI or Flask as a model-serving layer between Alpaca and your AI engine.

Event-Driven Infrastructure

Alpaca’s webhook/REST hybrid supports event-based workflows.

Example: “On order fill” → trigger model recalibration or portfolio rebalancing.

Tip: Use message queues like RabbitMQ or Kafka to manage asynchronous events efficiently.

Security & Compliance

Alpaca API: SEC-regulated broker-dealer; offers secure HTTPS protocols and token-based authentication.

Tidio AI: GDPR-compliant, SSL encrypted; not designed for financial transactions.

Implication: For real-money trading applications, Alpaca is the only secure and compliant choice.

Recommended Tech Stack: Building an AI-Powered Trading Bot (Hybrid Use)

Option 1: End-to-End Trading Bot (With Alpaca)

Frontend: React + Tailwind CSS (for UI)

Middleware: FastAPI (Python) or Node.js

AI Layer: LSTM or GPT model deployed via Docker

Trading Engine: Alpaca SDK + Redis (for real-time signal queue)

Monitoring: Prometheus + Grafana (for bot behavior and order stats)

Option 2: Conversational Bot Interface + Trading API Backend

Frontend: Tidio AI widget + custom HTML dashboard

Webhook Handler: Google Cloud Functions or AWS Lambda

Model Inference: OpenAI API or Hugging Face endpoint

Order Execution: Alpaca API triggered via secure cloud backend

Security Layer: Firebase Auth or Auth0 (optional)

Bonus: AI Strategy Enhancements

Sentiment Analysis Bot: Scrape financial news, run it through a BERT-based classifier, and execute trades based on sentiment shifts.

Time Series Prediction: Train a transformer-based model using Alpaca’s historical bar data (daily/15-min) to forecast asset prices.

Reinforcement Learning: Use Deep Q-learning agents to optimize entry/exit points, simulated on Alpaca’s paper trading account.

While both platforms leverage AI, Alpaca API is the clear winner for anyone serious about building AI-powered trading bots. It offers the tools, compliance, and market access required for effective and secure trading automation.

Tidio AI, on the other hand, serves best as an interface layer—helpful for those wanting to wrap a trading system in a conversational, humanized shell. If you’re designing a smart assistant that can talk about trades, Tidio might be your choice—but when it comes to executing them, Alpaca holds the crown.

Bonus: AI Stack Suggestion for Trading Bots

For those serious about development:

Data Ingestion: Alpaca API + Polygon.io

AI Engine: GPT-4 + LSTM/RNN (for predictions)

Execution: Alpaca Order API

Interface (optional): Tidio AI + Webhooks

Subscribe To Our Newsletter

All © Copyright reserved by Accessible-Learning Hub

| Terms & Conditions

Knowledge is power. Learn with Us. 📚