Thinkorswim vs eToro: Fees, Features, and Tools for Every Trader

Thinkorswim vs eToro 2025: A complete trading platform breakdown covering fees, execution, charting, automation, and social trading tools—for beginners and advanced traders alike.

EDITOR/TOOLSAI/FUTURESTOCK MARKETBANKING/CASH-FLOW

Keshav Jha

8/22/20254 min read

Choosing the right trading platform in 2025 isn’t just about fees—it’s about how a platform aligns with your strategy, asset preferences, and style of execution. Thinkorswim and eToro cater to very different trader profiles: one is an advanced, data-rich toolkit for active traders, while the other thrives on community-driven investing and accessibility. This guide breaks down their core features, pricing, usability, and best-fit scenarios so you can make a confident choice.

Thinkorswim

Developed by TD Ameritrade and now integrated into Charles Schwab, Thinkorswim is a professional-grade trading suite with desktop, web, and mobile platforms. It’s built for active traders who demand deep charting, advanced order types, and multi-asset market access—including stocks, ETFs, options, and futures.

Strengths

Advanced charting tools with hundreds of technical studies and customizable layouts.

PaperMoney® demo account for practicing with virtual funds.

Direct market access with complex order routing and advanced order types.

Multi-asset trading from a single dashboard.

Advanced Trading Capabilities

Order Execution & Routing

Supports direct market access (DMA) for equities and options.

Smart routing algorithms designed to optimize price improvement and execution speed.

Conditional orders including OCO (One-Cancels-Other), OTO (One-Triggers-Other), and order chains for multi-leg strategies.

Scripting & Automation

thinkScript® language for custom indicators, backtesting strategies, and conditional alerts.

Ability to build dynamic watchlists with real-time data scanning.

Data Feeds

Tick-by-tick Level I and optional Level II market depth.

Historical data spanning decades for equities, options, and futures—enabling long-term backtesting.

Risk Management

Real-time Greeks monitoring for multi-leg options.

Intraday VaR (Value at Risk) estimations via risk profiles.

Beta-weighted portfolio analysis to measure exposure against benchmarks.

Asset Class Depth

Options: Support for complex multi-leg spreads (iron condors, butterflies, and ratio spreads).

Futures: Wide coverage from equity indexes to metals, energy, interest rates, and agricultural products.

Forex (legacy accounts): Advanced charting and 6-day/24-hour access.

Bond Trading: Access to U.S. Treasuries, corporate bonds, and munis with integrated yield calculators.

Analytical & Quant Tools

Probability Analysis Module: Forecast expected price ranges based on implied volatility.

Economic Data Integration: Built-in FRED database overlays on charts.

OnDemand Replay: Simulates historical market sessions tick-by-tick for strategy testing.

Custom Alerts: Scripted triggers based on price, technical indicators, or news events.

Regulatory & Market Access Differences

Fully regulated under U.S. SEC, FINRA, and CFTC.

Direct access to U.S. exchanges with professional-grade margin rules (Reg T, portfolio margin for qualified accounts).

eToro

eToro is a global multi-asset broker famous for its social trading features like CopyTrader™, allowing you to replicate the strategies of successful traders. The U.S. platform offers stocks, ETFs, options, and crypto*, with an expanding product lineup and a beginner-friendly interface.

Crypto trading is not available in Hawaii, New York, Nevada, Puerto Rico, or the U.S. Virgin Islands.

Strengths

CopyTrader™ to mirror strategies of top-performing traders.

Social feed & sentiment data to spot trending assets.

Easy account setup and intuitive mobile experience.

24/5 stock & ETF trading plus tokenized stocks (rolling out in 2025).

Advanced Trading Capabilities

Order Execution

Primarily uses internalized order routing for certain instruments, focusing on spread stability.

Instant market and limit order placement for supported assets.

Stop loss and take profit are integrated by default into trade tickets.

CopyTrader™ Algorithm

Weighted allocation proportional to capital invested in the copied trader.

Automatic mirroring of open trades and proportional adjustments when the leader modifies positions.

API & Third-Party Integration

Limited open API access (primarily for partners and data services), unlike Thinkorswim’s scripting ecosystem.

Data streams optimized for the eToro app environment—no raw market data feed like DMA platforms.

Risk Controls

Equity-based drawdown limits for copy trading.

Automatic position scaling to prevent overleveraging based on account equity.

Asset Class Depth

CFDs (non-U.S. markets): Leverage-based trading in commodities, indices, and currencies.

Crypto Assets: Supports dozens of tokens with staking options for select coins (availability varies by region).

Tokenized Stocks: Fractional ownership of equity-like tokens, traded outside traditional exchange hours.

Analytical & Quant Tools

Social Sentiment Data: Aggregates community activity to rank assets by popularity and momentum.

Smart Portfolios: Thematic baskets (e.g., renewable energy, crypto leaders) curated by eToro analysts.

Risk Score Algorithm: Quantifies historical volatility and drawdown behavior for each trader in the copy system.

Regulatory & Market Access Differences

U.S. entity regulated by FINRA and FinCEN (for crypto), with global branches regulated in multiple jurisdictions (FCA, CySEC, ASIC).

The market access model varies—direct market execution for stocks/ETFs in the U.S. and the market-maker model for some CFD products abroad.

User Experience & Learning Curve

Thinkorswim has a steeper learning curve due to its institutional-level tools. It’s ideal for traders willing to invest time in mastering features.

eToro is highly approachable for beginners, with guided onboarding and a more visual, social-driven approach.

Bottom Line for Advanced Traders

If you need deep market access, customizable automation, and professional-grade analytics, Thinkorswim’s thinkScript® and robust market data feed make it the superior technical choice. If your edge comes from social signals, thematic investing, and passive portfolio replication, eToro’s ecosystem gives you exposure to curated strategies with built-in risk caps.

Best for…

Thinkorswim → Active U.S.-based traders, options & futures specialists, chart analysts, and those who value paper trading.

eToro → Social-first investors, beginners looking for guidance, crypto enthusiasts (outside restricted states), and global traders.

If you thrive on technical depth and complete control, Thinkorswim offers a powerhouse of professional tools with competitive pricing. If you prefer community insights, ease of use, and multi-asset access in one place, eToro is the better fit. Your choice depends on whether you want to trade like an analyst or invest like a networked thinker.

FAQ's

Q: Is Thinkorswim free to use?

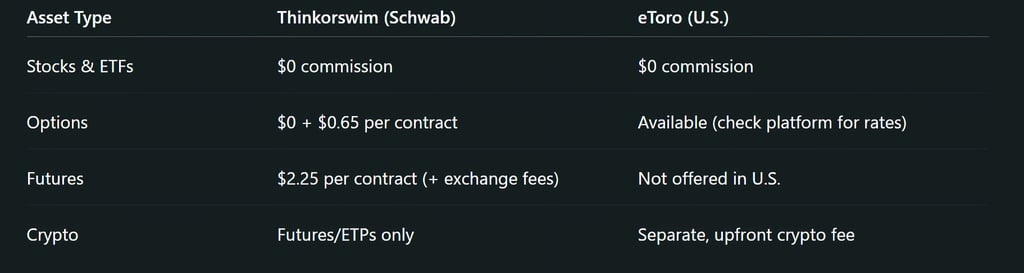

Yes. The platform itself is free, with $0 commissions on U.S. stocks and ETFs. Options and futures have per-contract fees.

Q: Can I trade crypto on Thinkorswim?

Not directly. You can trade crypto futures and ETFs, but there’s no spot crypto trading.

Q: Does eToro allow copy trading in the U.S.?

Yes, U.S. users can use CopyTrader™ for eligible assets.

Q: Which platform is better for beginners?

eToro is generally more beginner-friendly due to its simple interface and social features.

Q: Can I practice trading on eToro?

Yes, eToro offers a virtual portfolio for risk-free practice.

Subscribe To Our Newsletter

All © Copyright reserved by Accessible-Learning Hub

| Terms & Conditions

Knowledge is power. Learn with Us. 📚