RBI Digital Lending Directions 2025: Full Overview of India’s New Fintech Compliance Rules

The Reserve Bank of India has issued the Digital Lending Directions 2025 to regulate digital loans, protect borrowers, and strengthen fintech compliance. Learn about key rules, penalties, and their impact on NBFCs, banks, and loan apps.

NEWS/CURRENT AFFAIRSEDUCATION/KNOWLEDGESTOCK MARKETBANKING/CASH-FLOW

---

5/15/20253 min read

In March 2025, the Reserve Bank of India (RBI) released an updated framework for digital lending, building on its 2022 guidelines. This time, the focus is sharper, enforcement is stricter, and protections are wider.

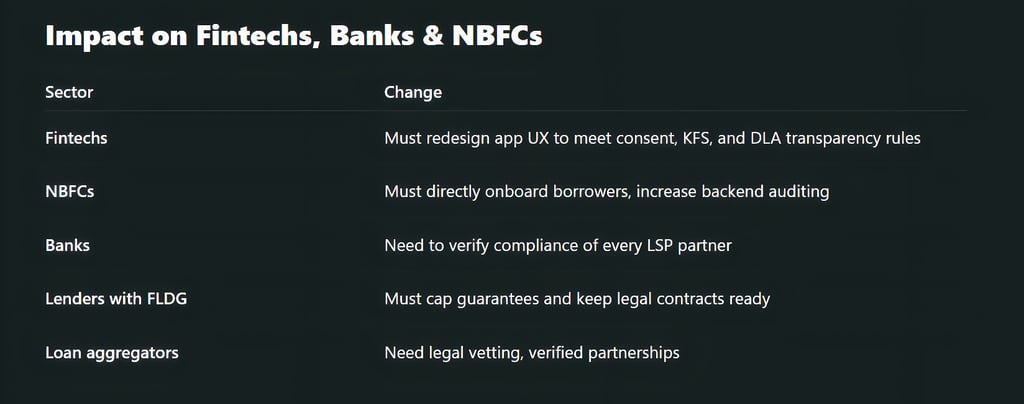

These Digital Lending Directions 2025 are applicable to all regulated entities (REs) and their digital lending partners, including fintech firms, NBFCs, and digital lending apps (DLAs). The goal is to rein in rogue lending practices, safeguard borrowers, and establish a transparent ecosystem for credit delivery in the digital era.

Why Digital Lending Needed Reform

India’s digital lending sector has grown at over 100% CAGR in the past five years, but

Over 2,500 illegal loan apps operated in India in 2023 alone

Several cases of data theft, harassment, and cyber extortion emerged

Loans were issued with ambiguous terms, hidden charges, and coercive recovery practices

Many apps masqueraded as NBFCs without RBI approval

These issues undermined public trust and exposed borrowers—especially those in underserved areas—to severe exploitation.

Scope of the RBI Digital Lending Directions 2025

These directions apply to:

Regulated Entities (REs): All RBI-licensed banks and NBFCs

Lending Service Providers (LSPs): Fintech firms acting as intermediaries

Digital Lending Apps (DLAs): Online platforms offering or processing loans

They do NOT apply to:

Moneylenders governed by state laws

Non-digital lending (offline)

Lending among friends/family or unregulated p2p arrangements

Key Provisions

Direct Loan Flow Between Borrower & RE

All loan disbursals and repayments must occur between the borrower’s and RE’s bank accounts only.

No use of LSP-controlled pool accounts.

Why it matters: This reduces fraud and misdirection of funds and makes auditing easier.

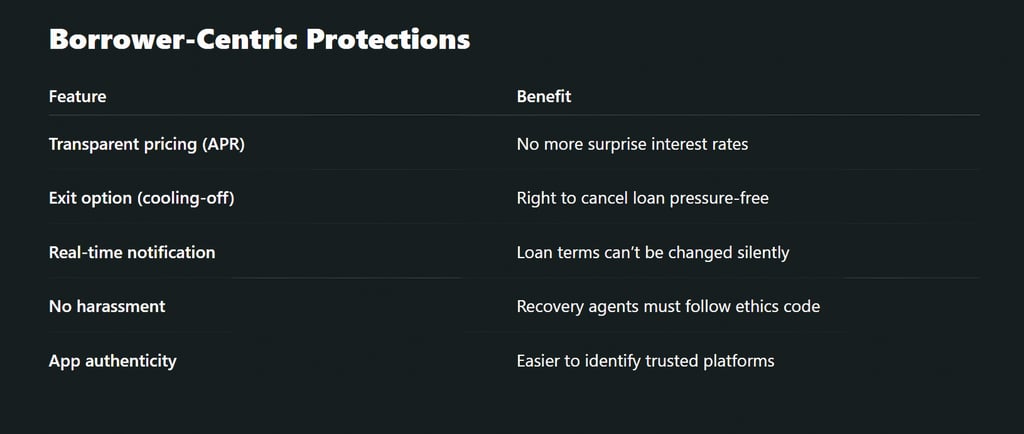

Mandatory Key Fact Statement (KFS)

A digital one-page document showing:

Loan amount, tenure, APR

Processing fee, GST, penalties

Repayment schedule and method

Cooling-off and prepayment terms

Why it matters: Ensures informed consent and avoids hidden costs.

Digital Consent Architecture

Borrower consent must be clear, informed, and granular

No pre-ticked boxes or bundled permissions

Access to contact list, SMS, or camera is banned unless essential and permitted

Why it matters: Protects user privacy, aligns with India's Data Protection Bill

Cooling-Off and Exit Window

Every borrower will have a 3- to 7-day exit period after loan disbursal to cancel the loan with no penalty.

Why it matters: Protects users from predatory or impulse-based borrowing.

Standardized App Disclosure & Transparency

All REs must publicly list their authorized DLAs and LSPs on their websites

DLAs must display their RE partners' names clearly

No ambiguous branding like “RBI-approved” or “Govt-affiliated.”

Why it matters: Helps users distinguish between legal and fraudulent apps.

Grievance Redressal Framework

Borrowers must be told how to file complaints

REs must resolve them in within 30 days

RBI will actively monitor complaint trends

Why it matters: Creates a feedback loop and enhances accountability.

Use of First Loss Default Guarantee (FLDG)—Updated

RBI has re-allowed FLDG with strict caps:

LSPs can cover up to 5% of the loan loss

Must be backed by written contracts

All FLDGs must be reported to RBI

Why it matters: Encourages innovation while preventing moral hazard.

Enforcement & Penalties

Violations may lead to:

Hefty monetary penalties (₹5 lakh to ₹1 crore per case)

Deregistration of NBFCs or REs

Google Play Store or iOS delisting of rogue apps (in partnership with MeitY)

Public blacklisting through the RBI portal

RBI has also launched a dedicated reporting portal for users to flag suspicious lending activity.

How It Aligns with Other Laws

The RBI’s 2025 guidelines complement

Digital Personal Data Protection Act (2023)

Consumer Protection (E-Commerce) Rules, 2020

Information Technology Rules (Intermediary Guidelines), 2021

Together, these laws form a robust digital economy regulatory shield for Indian users.

The RBI Digital Lending Directions 2025 represent a progressive leap toward safer, more ethical, and innovation-friendly digital credit in India. By drawing clear lines of responsibility, emphasizing data protection, and ensuring borrower dignity, these norms offer a blueprint for sustainable fintech growth.

Digital lending has enormous potential—but only when built on trust and transparency. With the 2025 norms, India is taking firm steps in that direction.

FAQs

What happens if I take a loan from an unlisted app?

You should stop payments, report the app on the RBI Sachet Portal, and file a cyber complaint.

Can a lending app call my relatives or employer?

No. That’s a violation unless you have explicitly consented.

Are buy-now-pay-later (BNPL) services covered under these rules?

Yes, if the BNPL service is offered via a registered NBFC or bank.

Are there any exemptions for micro loans or instant credit?

No. All digital lending—regardless of amount—is regulated under these guidelines.

Where can I find a list of legal loan apps?

Check the respective RE or NBFC website. RBI may also maintain a central repository soon.

Subscribe to our newsletter

All © Copyright reserved by Accessible-Learning

| Terms & Conditions

Knowledge is power. Learn with Us. 📚