PAN 2.0: Transforming Financial Systems in the Digital Age?!

Discover how PAN 2.0 is revolutionizing India's financial ecosystem with instant issuance, enhanced security, and streamlined compliance. Learn its benefits, why it’s needed, and how it empowers individuals and businesses in a digital economy.

NEWS/CURRENT AFFAIRSMODERN INDIAGOVERNMENT SKIMSTOCK MARKET

Sachin K Chaurasiya

11/28/20244 min read

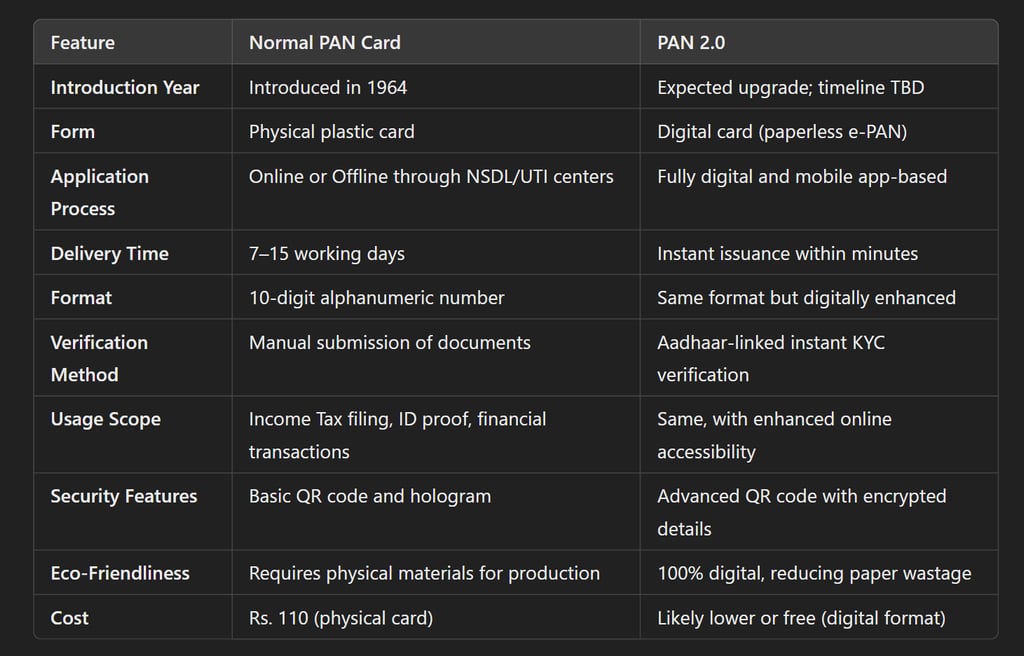

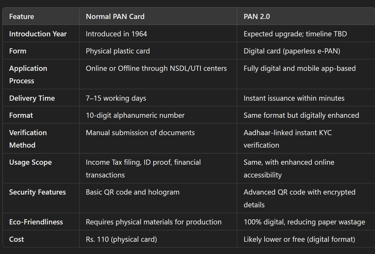

The Indian government has introduced PAN 2.0, an upgraded version of the Permanent Account Number (PAN) system, to make financial transactions and tax compliance more efficient, secure, and accessible. This transformation is a step towards strengthening India’s digital infrastructure and ensuring transparency in financial dealings. But what exactly is PAN 2.0, and why is it necessary?

Let’s dive into its features, benefits, and the role it plays in modernizing India's financial landscape.

What is PAN 2.0?

PAN 2.0 represents the evolution of the traditional PAN system, integrating cutting-edge technology for instant issuance, seamless processing, and robust security. This system is designed to address the limitations of the old system, such as delays in processing, risk of misuse, and lack of digital integration.

The new system leverages technologies like AI-driven analytics, real-time data verification, and cloud-based processing to ensure swift, transparent, and secure operations.

Key Features

Instant PAN Issuance

Individuals can now obtain their PAN in real-time through Aadhaar-based authentication. This reduces waiting times from weeks to mere minutes.

Paperless Process

PAN 2.0 eliminates the need for physical documents, making the application and verification process completely online.

Enhanced Data Security

Advanced encryption and fraud detection mechanisms ensure the safety of sensitive user information.

Seamless Integration

The upgraded system connects with platforms like the Income Tax Portal, GSTN, and e-KYC services, simplifying compliance for individuals and businesses.

Fraud Prevention

AI-powered analytics monitor transactions to identify and prevent suspicious activities tied to PAN misuse.

Accessibility

PAN 2.0 is designed to reach underserved regions, ensuring more people can participate in formal financial systems.

Why is PAN 2.0 Needed?

Combat Tax Evasion and Fraud

With India’s economy digitizing rapidly, the risk of fraud and misuse of financial identities has increased. PAN 2.0 introduces better tracking and accountability mechanisms to curb tax evasion.

Streamline Financial Systems

By integrating PAN with various financial and governmental platforms, PAN 2.0 ensures a smoother, interconnected ecosystem.

Support Digital India Vision

The government’s mission to create a digital-first economy relies on systems like PAN 2.0 that simplify and secure financial transactions.

Encourage Financial Inclusion

Rural populations and small businesses, previously hindered by complex bureaucracy, can now access financial systems more easily.

Benefits of PAN 2.0!

Time-Saving

From quick issuance to faster verification, PAN 2.0 saves individuals and businesses valuable time.

Improved Transparency

Automated tracking and monitoring of financial activities enhance trust and reduce corruption.

Ease of Compliance

Filing income tax, registering for GST, or even opening a bank account becomes hassle-free.

Global Competitiveness

With streamlined systems, India positions itself as a global leader in digital financial governance.

User-Friendly Experience

The paperless and mobile-friendly processes ensure convenience for users of all ages and backgrounds.

Technological Backbone of PAN 2.0!

PAN 2.0 is powered by modern digital technologies to ensure seamless integration and real-time operation. Key elements include:

Artificial Intelligence and Machine Learning (AI/ML)

AI-powered algorithms analyze transaction patterns, ensuring better fraud detection and predictive analytics to identify risks before they escalate.

Blockchain Integration (Proposed Future Feature)

Blockchain technology may be introduced in future iterations to further enhance data security, ensuring tamper-proof records.

Cloud-Based Infrastructure

A cloud-based backend system ensures scalability, enabling millions of users to access services simultaneously without delays.

Mandatory Linking with Aadhaar!

PAN 2.0 is designed to work seamlessly with the Aadhaar ecosystem. Linking PAN with Aadhaar is mandatory, enabling real-time verification and eliminating duplicate PAN cards.

This integration ensures!

Single identity across financial platforms.

Better tracking of income sources and transactions.

Role in Simplifying Compliance for Startups and MSMEs

Faster Business Registration

Startups and small businesses can use PAN 2.0 for instant GST registration and other financial formalities.

Ease of Credit Access

PAN-linked e-KYC makes it easier for MSMEs to secure loans by streamlining credit checks and approvals.

Impact on Tax Filing & Monitoring

Pre-Filled ITR Forms

PAN 2.0 enables the Income Tax Department to pre-fill data in tax returns, making filing faster and more accurate.

Tracking Black Money

It allows authorities to monitor high-value transactions, reducing instances of unreported income.

Challenges in Implementation

While PAN 2.0 brings significant advantages, certain challenges remain:

Digital Literacy

Ensuring rural and underserved populations understand and utilize PAN 2.0 effectively.

Infrastructure Gaps

Some regions still lack the necessary digital infrastructure for smooth adoption.

Cybersecurity Threats

Despite advanced encryption, evolving cyber threats require continuous updates to maintain data security.

Future Scope

The government plans to extend PAN 2.0's functionalities further, such as:

Universal Identity Number

Using PAN 2.0 as a single ID for all government services beyond financial platforms.

Global Compatibility

Making PAN 2.0 interoperable with international financial systems, benefiting Indians engaged in global trade or living abroad.

Automation of Tax Notices

Future systems may use AI to automatically send notifications for discrepancies, refunds, or pending filings.

How Does PAN 2.0 Impact You?

If you're a taxpayer, entrepreneur, or someone making high-value financial transactions, PAN 2.0 offers a simplified and secure experience. It ensures that all financial dealings are traceable, which is crucial for long-term economic growth and personal financial security.

PAN 2.0 is more than just an upgrade; it’s a milestone in India's journey toward becoming a transparent and tech-driven economy. By making financial systems more accessible, efficient, and secure, PAN 2.0 benefits both individuals and businesses while supporting the government’s goal of a digitally empowered India.

Embracing PAN 2.0 is not just a necessity for compliance; it’s an opportunity to be part of a revolution that’s shaping the future of Indian finance.

Subscribe to our newsletter

All © Copyright reserved by Accessible-Learning

| Terms & Conditions

Knowledge is power. Learn with Us. 📚